We are happy to take the next big step in our journey by growing our presence in India’s ecommerce technology sector with the Identixweb IPO.

If you want to invest in a fast-growing SaaS company shaping the future of ecommerce, this is your chance. Learn more about our IPO and follow this step-by-step guide to apply, understand the process, and make informed investment decisions.

Understanding Identixweb Limited’s IPO

We provide SaaS solutions, app development, and web innovation to help online businesses grow with scalable, high-performance technology. We are also committed to change and growth. We create solutions that streamline processes, enhance sales, and improve user experiences, keeping pace with the evolving digital market.

As we take the next step with our IPO, we invite investors to join our process. With a Built Issue valued at ₹16.63 crore, our public offering marks an exciting milestone, fueling our expansion, product development, and operational excellence.

The IPO will feature 30.80 lakh fresh issue shares, open for subscription from March 26, 2025, to March 28, 2025. The allotment is set for April 1, 2025, with a tentative listing on the BSE SME exchange on April 3, 2025.

Join us as we redefine ecommerce technology and drive the next wave of digital transformation.

Why Invest in Identixweb’s IPO?

Offering a chance to invest in a fast-growing tech company focused on Shopify apps. Here’s why it could be a great opportunity:

- High Growth Potential – The e-commerce and SaaS industries are expanding rapidly, positioning Identixweb for future success.

- Early Entry Advantage – IPO investors can buy shares at a lower price before they are publicly traded.

- Strong Market Position – Identixweb is a trusted name in the Shopify app development industry, serving thousands of online businesses.

- Long-Term Gains – If the company performs well, stock prices may appreciate significantly, offering solid returns.

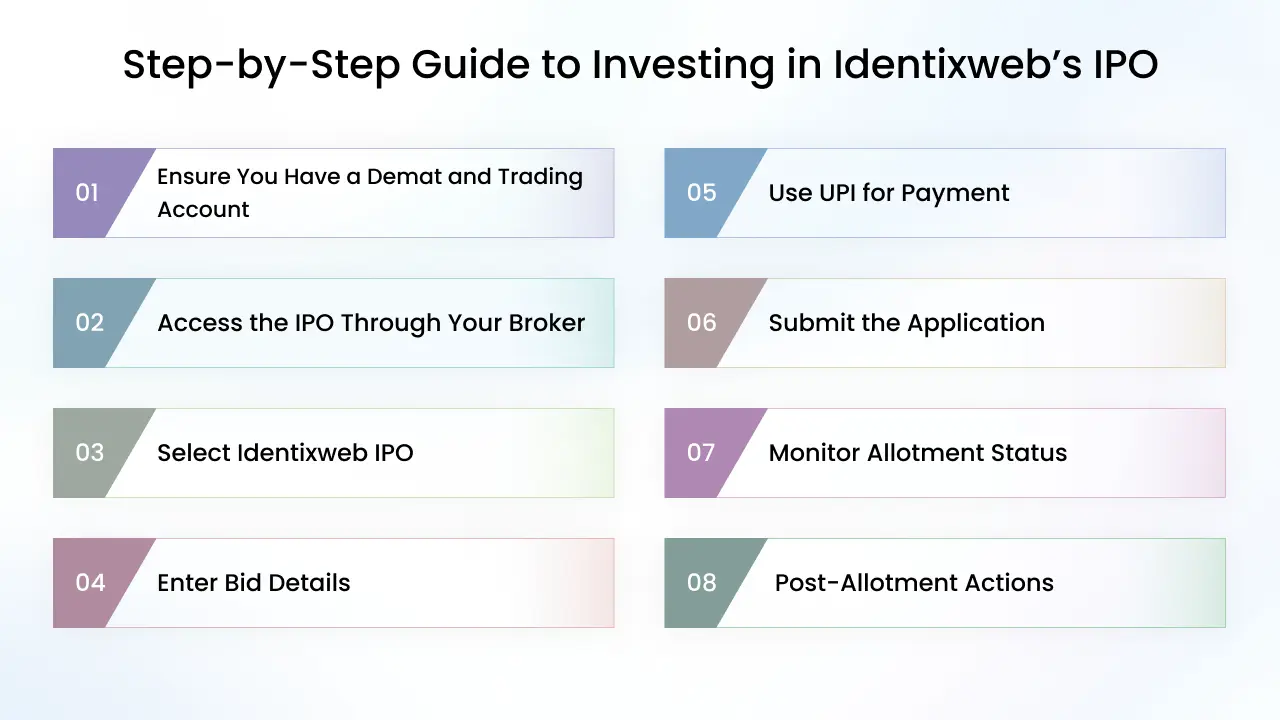

Step-by-Step Guide to Investing in Identixweb Limited IPO

Investing in an IPO can be a great opportunity, but following the proper process to secure your shares is the main focus. Here’s a step-by-step guide:

Ensure You Have a Demat and Trading Account

You need a Demat account to hold shares and a trading account to buy or sell them. If you don’t have one, you can open one with a registered stockbroker.

Access the IPO Through Your Broker

Log in to your broker’s platform (website or mobile app) and navigate to the IPO section. Brokers like Zerodha, Angel One, and Groww offer online IPO application services.

Select Identixweb IPO

In the IPO section, select the Identixweb IPO from the list of available offerings.

Enter Bid Details

- Number of Lots: Specify the number of lots you wish to apply for. The minimum lot size is 2,000 shares.

- Bid Price: Enter your bid price within the specified range (₹51 to ₹54 per share). To increase the chances of allotment, consider bidding at the cut-off price (₹54 per share).

Use UPI for Payment

Enter your UPI ID linked to your bank account. After applying, you will receive a mandate request in your UPI app. Approve this request to block the required funds in your bank account. This process is known as ASBA (Application Supported by Blocked Amount). Make sure the funds remain in your account until the allotment is offered.

Submit the Application

Review all the details carefully and submit your IPO application. You should receive a confirmation from your broker upon successful submission.

Monitor Allotment Status

The allotment is expected to be finalized by April 1, 2025. You can check the allotment status through your broker’s platform or the registrar’s website by entering your PAN, application number, or Demat account details.

Post-Allotment Actions

- If Allotted: The shares will be credited to your Demat account, and you can trade them once they are listed on the BSE SME platform on April 3, 2025.

- If Not Allotted: The blocked funds will be released into your bank account.

Important Considerations

- SME IPOs: Identixweb’s IPO is listed on the BSE SME platform, which provides to small and medium enterprises. This may have different risk profiles and liquidity compared to mainboard IPOs. Ensure you understand these factors before investing.

- Consult Your Broker: For detailed instructions adapted to your broker’s platform and any specific eligibility criteria, consult your broker’s customer service or help resources.

Wrapping Up

Now that you know the process, you can see that Identixweb’s IPO is a great opportunity, but planning is necessary. You need to know about the company, understand the details and follow a straightforward investment process. Whether you aim for quick profits or long-term growth, an innovative strategy will help you maximize your investment.

FAQs

1. How can I find out the IPO date for Identixweb?

You can check the official Identixweb website, financial news platforms, or your brokerage firm’s IPO calendar for the latest updates.

2. What is the minimum investment required for Identixweb’s IPO?

The minimum investment required for Identixweb’s IPO is ₹1,02,000.

3. What are the risks of investing in an IPO?

This can be risky due to price ups and downs, no past performance to review, and possible drops after trading begins.

4. Can I sell my IPO shares immediately after listing?

Yes, you can sell your IPO shares after listing, but some brokers may have a lock-in period. Remember that prices can not be stable in the first few days.

5. What happens if my IPO application is not allotted any shares?

If you don’t receive an allotment, do not worry; your invested funds will be refunded to your bank account.

6. Where is the Identixweb IPO getting listed?

The Identixweb IPO is set to be listed on the BSE.

About the author

Bhavesha Ghatode

Explore Content with Bhavesha, a passionate and dedicated technical content writer with a keen understanding of e-commerce trends. She is committed to sharing valuable insights, practical assets, and the latest trends that can help businesses thrive in a competitive environment.